Buffalo Social Security Lawyer

Buffalo’s Top Rated Social Security Law Firm

Hurwitz, Whitcher & Molloy has successfully been representing workers’ compensation claimants for more than thirty-five years. In addition to Workers’ Compensation benefits, a disabled person may be entitled to Social Security Disability benefits. If you are looking for a Social Security lawyer in Buffalo, NY please contact us for assistance.

Should I apply for Social Security benefits?

Social Security Disability is available for people who have been disabled or expect to be disabled for a period of at least one year. If you are disabled and believe you qualify, please speak with an attorney immediately. A Social Security lawyer in Buffalo NY can provide you with valuable information needed when applying for benefits. You can apply by calling 1-800-772-1213, to make an appointment at your local Social Security office, or going online at www.socialsecurity.gov. You can apply for disability benefits as soon as you become disabled or when you believe your disability will last longer than one year, or result in death. Processing an application can take three to five months. The Social Security Administration will obtain medical evidence from your doctors in connection with your condition, when it began as well as the treatment and medical tests you have received. They will also ask your providers how your medical condition limits your physical activities, such as walking, standing, sitting, lifting and carrying. If you have any impairments to your mental or cognitive functioning, that will also be reviewed.

If you want to apply for benefits or discuss your options, please call Hurwitz, Whitcher & Molloy. We can answer questions about Social Security Disability and connect you to a Social Security lawyer in Buffalo, NY. It is very common to initially receive a denial of your claim for Social Security benefits. If you are denied Social Security benefits, you can appeal the denial and request a hearing before an Administrative Law Judge. There are strict time limitations to request a review of the denial, so you should contact us immediately for assistance and guidance. When determining your eligibility for benefits, your work injury as well as any other medical conditions that are considered severe and cause significant impairment, will be examined. Your medical condition must significantly limit your ability to do basic work activities, to be considered disabling by Social Security. Your age, education and work history will also be weighed by the Social Security Administration so that they can determine if you can do your previous work or any other type of work, when considering your disability.

How much will I receive from Social Security Disability?

Similar to your Social Security Retirement benefits, your Social Security Disability benefits are based on your lifetime earnings and payment of taxes into the program. In general, you have to have 20 quarters of earnings into the system to be eligible. That equates to five years of employment in the ten year period before you become disabled. The rules are different for younger workers, who become disabled before establishing a significant work history. The average payment for Social Security Disability is $1,258.00 per month. The current maximum Social Security Disability benefit is $2,861.00. The Social Security Administration makes periodic increases to your benefits known as a cost of living adjustment. You can obtain Social Security Disability in addition to Workers’ Compensation benefits or other Long Term disability benefits. However, your Social Security benefits may be paid at a reduced rate due to the receipt of other benefits. The Social Security Administration will need information and documentation about your workers’ compensation benefits. If you are eligible for Social Security Disability benefits, your spouse, minor or disabled children may also be eligible for benefits. If you do not have enough quarters to be eligible for Social Security Disability benefits or you have limited income or resources, you may be entitled to Supplemental Security Income (SSI), a disability and income-based benefit. A Social Security lawyer in Buffalo, NY can assist you in navigating the Social Security system so please call with any questions.

How long can I receive Social Security Disability benefits?

Once approved for benefits you can receive benefits as long as you remain disabled. The Social Security Administration will periodically review your claim and contact your doctors to verify your ongoing disability and entitlement to benefits. When you reach your full retirement age, your Social Security Disability benefits will automatically be converted to your Regular Retirement benefits. The amount of your benefit will remain the same. If your Social Security Disability benefits are reduced due to the receipt of Workers’ Compensation, once you receive Social Security full or early retirement benefits, your benefits will no longer be offset. If Social Security determines that you are no longer disabled or if you return to work, earning over a certain amount, your benefits will be suspended.

Can I work if I am receiving Social Security Disability Benefits?

If you are receiving Social Security Disability benefits, you can work in a limited capacity and still receive your full Social Security benefits. Social Security’s Ticket to Work and work incentive programs can help if you are interested in working while receiving Social Security benefits. You can continue to receive benefits if your monthly earnings are below what the Social Security Administration considers Substantial Gainful Activity (SGA). The SGA amount changes each year. You should contact Social Security to discuss your work activity and report any earnings to determine if they are at, or below, the SGA level. The Social Security Administration allows a 9-month trial work program where you can earn an unlimited amount (higher than SGA) and still receive your Social Security benefits. If you are able to continue working past the 9-month trial work program and continue to earn SGA, your benefits will be suspended. If you are receiving Social Security benefits, it is important to notify the Social Security Administration anytime there is a change in your workers’ compensation benefits or if you return to work in any capacity. A Social Security lawyer in Buffalo, NY can provide you with additional information and help you navigate the system. Please call Hurwitz Whitcher & Molloy for assistance.

The Differences Between Workers’ Compensation VS Social Security Disability

Whether you have been hurt or became recently disabled, it’s natural for you to worry about where your next pay check is coming from. Working with a social security lawyer in Buffalo NY can ensure that you get the right kind of benefits in your circumstance, and that you are able to take advantage of every resource available to you. That said, before you call Hurwitz, Witcher, & Molloy LLP, it might be helpful to understand a little about what differentiates the standard social security disability insurance payout from workers’ compensation.

SSDI Is Available Without Injury at Work

If you have suffered an injury at your job site, you and your social security lawyer in Buffalo can fill out paperwork for SSDI to replace your regular paycheck. Similarly, you can get workers’ compensation as an added or replacement benefit. Both can be paid out if your injury happens on the job. However, if your illness or injury is not a result of your job, you can only collect SSDI.

SSDI Is Federal

SSDI, an insurance benefits program for injured and disabled workers who are unable to work, is run federally. It can take up to five months to be awarded SSDI, even with the help of your social security lawyer in Buffalo NY. On the other hand, workers’ compensation is a private sector payout. It is a type of benefit that your employer pays into as a sort of employers’ insurance on a monthly basis. If you are injured on the job and you hire Hurwitz, Witcher, & Molloy LLP to help you claim workers’ compensation, you may get your payouts much faster than those available to you on the federal level.

Workers’ Compensation and Social Security Are Temporary

The one factor that these two types of benefits for anyone who has been injured on the job is that they are both temporary. Once you are back on your feet and able to work again, your social security disability payments stop. If you go back to work once you have recovered from your injury, your workers’ compensation benefits get replaced with your regular paycheck. Talk to a social security lawyer in Buffalo NY about the pros and cons of applying for and claiming each type of benefit. For someone who is able to work again after a short recovery, workers’ compensation may be a better benefit to claim. However, if your injury resulted in a more permanent disability you should contact Hurwitz, Witcher, & Molloy LLP to help you apply for and be awarded SSDI.

Can You Receive Social Security Disability Along With Other Benefits?

If you have a disability that qualifies you for Social Security Disability, you may also qualify for other benefits, whether due to that disability or an unrelated one. The benefits may be either public or private in nature. For example, you may have become disabled due to a work-related injury, in which case you may be eligible for workers’ compensation as well as Social Security Disability. Your workers’ compensation may be paid out of your employer’s private insurance or a workers’ compensation agency of the state and federal government. In either case, you may have heard that receiving other benefits disqualifies you for Social Security Disability. This is not exactly true. Benefits such as workers’ compensation do not disqualify you from receiving SSD, but they may reduce the amount you can collect. A Social Security lawyer in Buffalo NY from the firm of Hurwitz, Witcher, & Molloy LLP can review your case, explain your options, and help you receive all the benefits you deserve.

How Do Workers’ Compensation and Other Benefits Affect SSD?

Under federal law, there are limits to how much you can receive in SSD and other benefits. Specifically, the total amount that you receive in benefits per month cannot be more than 80% of what you would have earned at your job before you became disabled. The Social Security Administration does not have the power to reduce the amount that you receive in workers’ compensation. Therefore, if the amount of benefits you receive monthly including Social Security Disability would exceed 80% of your pre-disability income, the amount that you are eligible to receive in SSD is reduced so that the total falls below that threshold. A Social Security lawyer in Buffalo NY cannot increase the amount that you can collect in benefits but can help you determine the amount that you should receive and help you collect as much as you deserve.

What Benefits Do Not Affect SSD?

While workers’ compensation affects the amount that you can receive in SSD, not all benefits do. For example, Supplemental Security Income is the responsibility of the SSA just as Social Security Disability is. If you collect both SSI and SSD, the former has no bearing on the amount you can collect for the latter. The same is true of Veterans Administration benefits even though another agency is responsible for it. You can see a Social Security lawyer in Buffalo NY at Hurwitz, Witcher, & Molloy LLP for help calculating 80% of your pre-disability income, as well as questions about qualifying and applying for SSD benefits.

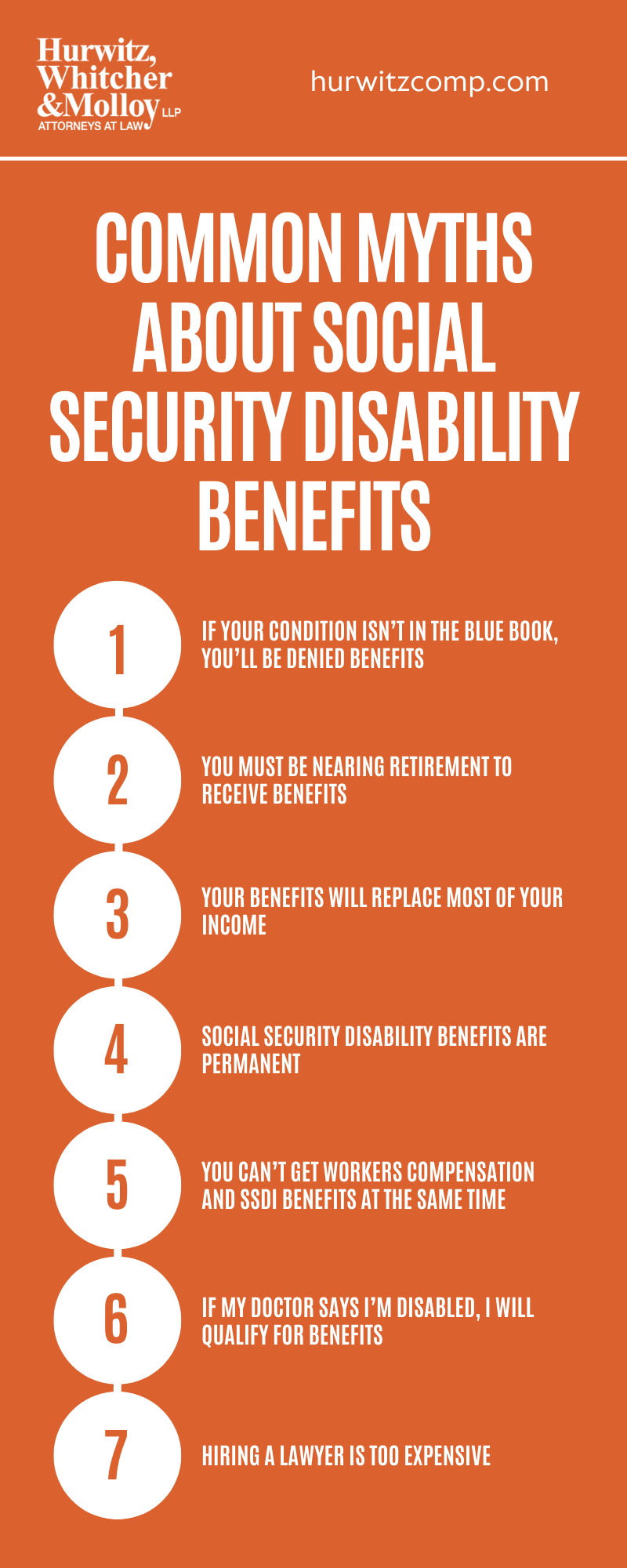

Common Myths About Social Security Disability Benefits

Social Security Disability benefits have been around for a long time, but there is still a lot of misinformation about them. If you are thinking about applying for these benefits, it is important for you to educate yourself about the facts. Here are some of the most common myths a social security lawyer Buffalo, NY residents trust hear.

- If Your Condition Isn’t in the Blue Book, You’ll Be Denied Benefits: The Blue Book is a document that lists physical and mental conditions severe enough to prevent a person from working. If your condition is not listed in the Blue Book, it does not mean your claim will automatically get denied. The Social Security Administration looks at every case on an individual basis and will determine if your condition is severe enough to warrant benefits.

- You Must Be Nearing Retirement to Receive Benefits: There are no age restrictions for applying for Social Security Disability benefits. The program is designed to provide benefits for anyone who can’t work because they suffer from a debilitating physical or mental condition. However, how much you receive in benefits will depend on your contributions to the Social Security trust fund. Elderly people have worked longer, so they will likely receive more benefits than their younger counterparts.

- Your Benefits Will Replace Most of Your Income: While it would be nice if Social Security Disability benefits replaced most of your income, it does not work that way. As a social security lawyer in Buffalo, NY can confirm, these benefits are meant to cover only basic living expenses. You may not be able to live the type of lifestyle you were accustomed to before.

- Social Security Disability Benefits Are Permanent: While some people are on Social Security Disability benefits for the rest of their lives, they aren’t permanent for everyone. If your condition is expected to get better, the SSA will review your case again in the next 6 to 18 months.

- You Can’t Get Workers’ Compensation and SSDI Benefits at the Same Time: Social Security Disability benefits are run by the federal government while workers’ compensation is a state program. You can receive both types of benefits at the same time.

- If My Doctor Says I’m Disabled, I Will Qualify for Benefits: It is true that your doctor’s assessment of your condition may help you get approved for Social Security Disability benefits, but it doesn’t guarantee anything. The SSA will make the final decision on whether you’re approved or not.

- Hiring a Lawyer Is Too Expensive: Some people shy away from hiring a social security lawyer in Buffalo, NY to represent them because they think they’re too expensive. However, most of these lawyers work on a contingency basis, meaning they take a percentage of your benefits.

Buffalo Social Security Infographic

How To Secure Your Social Security Benefits Without Hassle

With a clear approach, a Buffalo NY social security lawyer can help you move through the process efficiently, ensuring you don’t miss out on the benefits you’ve earned. Securing Social Security benefits can feel like a daunting task, but it doesn’t have to be. Many individuals find themselves uncertain about where to start, especially with the rules and regulations surrounding these benefits. Let’s look at how you can claim your Social Security benefits without unnecessary delays.

The Basics Of Social Security Benefits

The first step in this process is understanding what you’re entitled to and when you can claim it. Social Security benefits are primarily based on your work history and the contributions you’ve made throughout your career. Whether you’re approaching retirement, applying due to a disability, or helping a loved one, knowing the requirements upfront can save a lot of time and frustration. For those nearing retirement age, the age at which you choose to claim benefits can affect the monthly amount you receive. While some prefer to claim benefits as early as 62, waiting until full retirement age, or even later, can lead to larger monthly payments. It’s important to evaluate your financial situation and long-term plans when deciding the best time to start collecting.

Filing The Right Paperwork

One of the most common reasons for delays in receiving Social Security benefits is incomplete or incorrect paperwork. Filing your application properly from the beginning is crucial. When applying for benefits, whether retirement, disability, or survivor’s benefits, you’ll need to provide specific documentation. This may include proof of identity, work history, and any other information that verifies your eligibility. It’s also helpful to gather your work records in advance. This ensures you have a clear picture of your contributions and can quickly address any discrepancies that may arise. The Social Security Administration (SSA) can only process applications when all necessary documents are complete, so taking this step early can save a lot of time down the line.

Seeking Guidance To Avoid Hassles

Though the Social Security system may seem challenging, seeking guidance from professionals with experience in the process can make a world of difference. It’s important to work with a Buffalo social security lawyer who understands the requirements and can help you avoid the common mistakes that lead to delays or denials. This approach can be especially helpful for those applying for disability benefits, as the rules can be more stringent, and mistakes in the application are common. A little help goes a long way in ensuring everything is done correctly, giving you peace of mind that your application will proceed smoothly.

Taking The Next Step

Securing your Social Security benefits doesn’t have to be a complicated or stressful experience. By approaching the process with the right information and preparing your application thoroughly, you can avoid unnecessary delays and receive the benefits you’re entitled to without hassle. If you’re unsure about where to start or how to proceed, don’t hesitate to reach out to a Buffalo Social Security lawyer for professional legal assistance. With over thirty-five years of legal experience, our team at Hurwitz, Whitcher & Molloy is dedicated to helping you fight for your rights. Contact us today to schedule your risk-free consultation!